Compound interest calculator with variable deposits

This is the reason why. Online savings accounts come with variable interest rates which banks can raise and lower for several reasons.

1

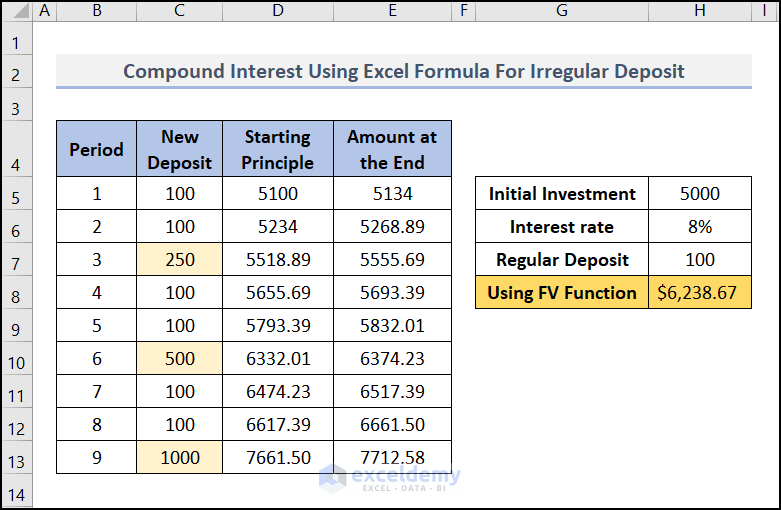

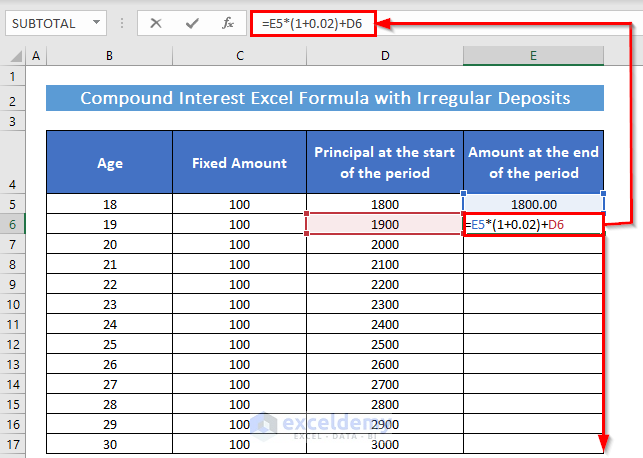

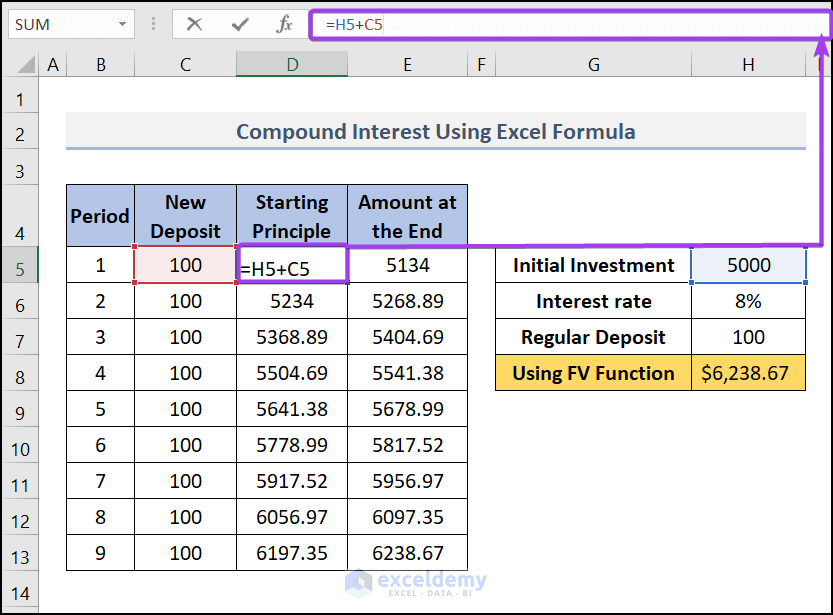

Note These formulas assume that the deposits payments are made at the end of each compound period.

. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. For example a variable annuity with a 10-year surrender charge period will pay a higher commission than one with a 5-year surrender charge which results in a higher commission fee for the investor. Variable interest rates also known as floating interest rates are not fixed but are dependent on market performance.

Monthly compound interest is the most common method used by financial institutions. The majority of Australian savings accounts that provide compound interest allow you to make withdrawals and additional deposits whenever you need to. If youd prefer to try your hand at calculating interest without a calculator use the compound interest formula.

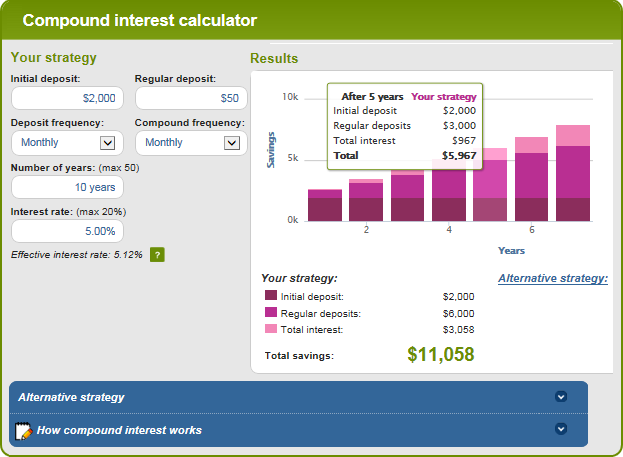

High Interest Savings Accounts Comparison. 5 x 1000 x 4 200. Using this compound interest calculator Try your calculations both with and without a monthly contribution say 50 to 200 depending on what you can afford.

In addition to showing the growth of compound interest this calculator also lets savers account for the impact of income tax on their interest income adjust the purchasing power of their final savings to account for the impacts of inflation. Iron ˈ aɪ ər n is a chemical element with symbol Fe from Latin. This calculator will help you to determine the future value of a monthly investment at various compounding intervals.

We are constantly shown numbers which are stripped of context. Teaser raters on adjustable mortgages APR rates on credit cards which dont highlight other fees or the compounding effects and secured credit cards which have an effective APR of above 100 after paying for the membership fee - and whats worse is that on a secured credit. Updated Study Notes and Revision Kits MASOMO MSINGI PUBLISHERS.

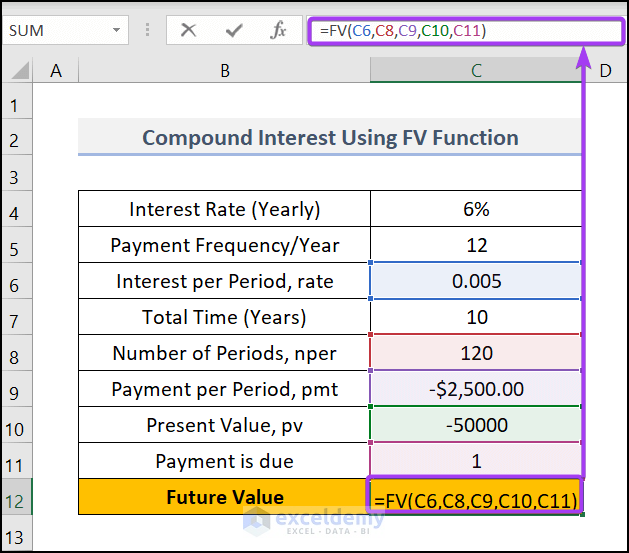

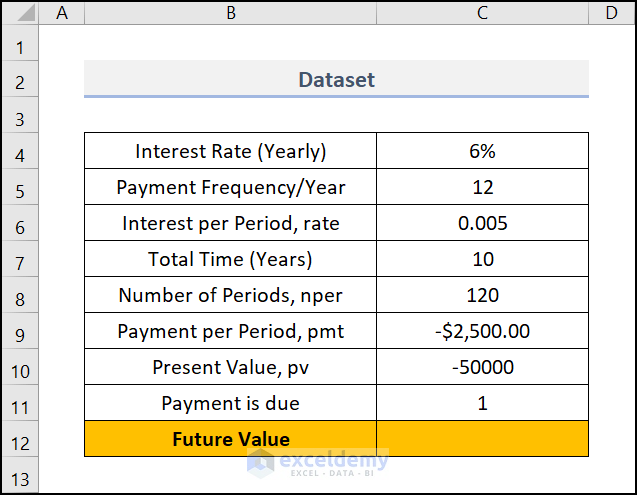

A simple way to calculate compound interest is to use the following formula. The pv variable which is optional is the amount of the initial deposit and the type refers to whether the payment is made at the end of the period which is what most banks do thus giving this variable a value of 1. Using this monthly compound interest calculator you can accurately determine the result of compound interest on your investments when compounded monthly.

Inflation will peak at 186 in early 2023 and the Bank of England could need to hike interest rates to 7 to get it under control warns Citi. So by the fifth year your annual interest would have risen from 5116 to 6246 an increase of 22 per cent. If the market is volatile interest rates also change dramatically.

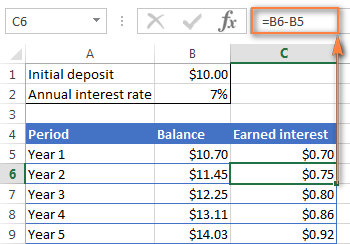

3 Formulas to Calculate Monthly Compound Interest in Excel Formula 1. High interest savings accounts offer more competitive interest rates to help your savings grow. A P1 rnnt where.

You will also find the detailed steps to create your own Excel compound interest calculator. In general commissions for variable annuities average around 4 to 7 while immediate annuities average from 1 to 3. It is a metal that belongs to the first transition series and group 8 of the periodic tableIt is by mass the most common element on Earth right in front of oxygen 321 and 301 respectively forming much of Earths outer and inner coreIt is the fourth most common.

Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested earning you more interest. This calculator will tell you how much interest you. Also the variable of compounding intervals for daily weekly.

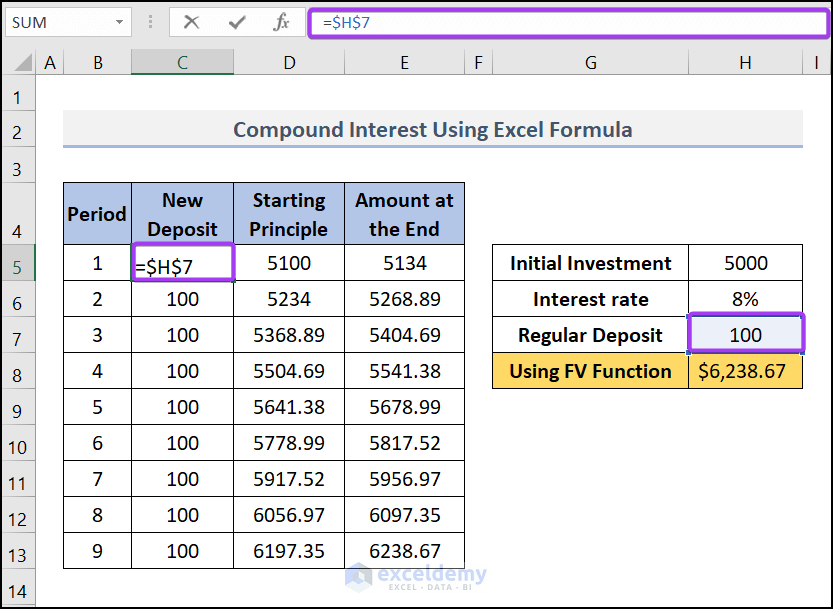

APYs are often adjusted when the Federal Reserve changes its benchmark interest rate. Calculate Monthly Compound Interest Manually in Excel Using the Basic Formula. As a wise man once said Money makes money.

A ending amount this means original balance plus. All these deposits in months ie. In various banks various rate of interest starting and ending dates.

Term deposits allow you to lock in a certain amount of money at a specified rate for an agreed period of time between 3 months and 5 years. Compare ineterst paid at maturity vs quarterly vs annually. VARIABLE INTEREST RATE 369.

All high interest-earning savings accounts have variable rates meaning they could go up or down over time usually in response to changes to the Reserve Bank cash rate. 152227 37 months like this. Owner Occupied Variable PI 70.

Interest is usually calculated based on the principal and it can be easily calculated using this Interest Calculator. Are term deposits compound interest. This savings calculator includes.

Use InfoChoice free online Term Deposit Calculator to calculate your total compound interest. Ferrum and atomic number 26. The Capital One Quicksilver Cash Rewards card is a decent option for a balance transfer offering 15 months of intro zero-interest before its regular APR of 1649 percent to 2649 percent variable.

Compound interest on the other hand occurs when your interest earned then earns additional interest. In this method well use the basic mathematical formula to calculate monthly compound interest in Excel. The nper variable is the length or number of periods.

When you work with an. For example if the simple interest rate is 5 on a loan of 1000 for a duration of 4 years the total simple interest will come out to be. Suppose a client borrowed 10000 at a rate of 5 for 2 years from a bank.

The pmt variable is how much is being paid. Savers can use this free online calculator to figure out how quickly their savings will grow if they make regular monthly deposits. Year 4 would see a deposit of 10927 etc.

Compound interest is calculated not just on the basis of the principal amount but also on the accumulated interest of previous periods. According to Figure 1 this means that type0 the default for the FV functionIf I wanted to deposit 1000 at the beginning of each year for 5 years the FV function in Excel allows me to calculate the result as FV45-10001 where type1Just remember that. To calculate the future value of a monthly investment enter the beginning balance the monthly dollar amount you plan to deposit the interest rate you expect to earn and the number of years you expect to continue making monthly deposits then click the Calculate.

Future Value Of Varying Amounts And Time Periods Accountingcoach

Compound Interest Formula And Calculator For Excel

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Rls1q0igyhvsim

3

Compound Interest Calculator Certificates Of Deposit Mathematics For The Liberal Arts Corequisite

Rls1q0igyhvsim

Rls1q0igyhvsim

Compound Interest Formula And Calculator For Excel

Rls1q0igyhvsim

3

Rls1q0igyhvsim

Compound Interest Formula And Calculator For Excel

Rls1q0igyhvsim

Compound Interest Formula And Calculator For Excel

3

Pin On Best Infographics