30+ House affordability calculator

Each scheme has a starting from price for the available property types but if you would like further information you can get in. Use our home affordability calculator to find out how much house you can afford.

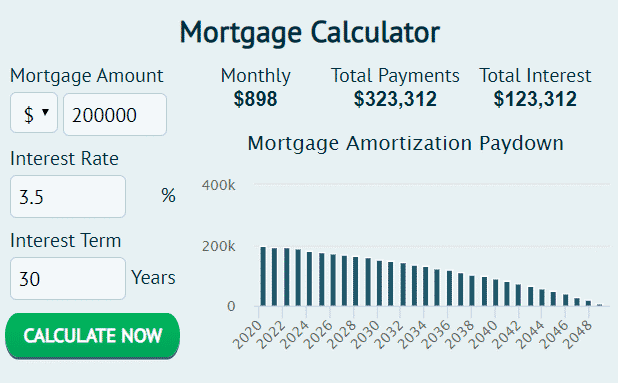

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

House 3 is a two-story brick cottage in Houston Texas.

. Your budget is 35 or 14000 and you plan to make a 20 down payment of 2800. To calculate how much you can afford you need your gross monthly income monthly debts down payment amount your home state credit rating and loan type. For a house this expensive lenders require a larger down payment 20 of the home value so Martin is limited to a house worth five times his savings minus that cash reserve equaling three months payments.

How much money could you save. Whether you are building your own house or getting a loan for home improvement the home construction loan calculator will calculate the monthly loan payments with an amortization table and chart that is exportable to an excel spreadsheet. Home Construction Loan Calculator excel to calculate the monthly payments for your new construction project.

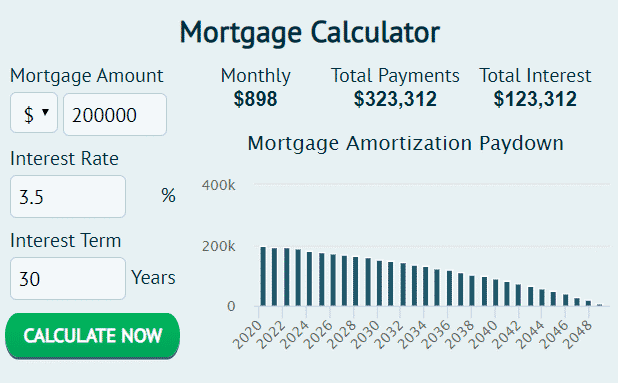

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. The monthly cost of a mortgage is higher with a shorter-term loan but. View up-to-date MLS listings in Toronto.

Most mortgages have a loan term of 30 years. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on. Refine your Toronto real estate search by price bedroom or type house townhouse or condo.

Section 8 housing which. 750 Above 700-749 550-699 550 Below What is your credit score range. Lets pretend that you make 40K a year.

Quickly find the maximum home price within your price range. There are two House Affordability Calculators that can be used to estimate an affordable purchase amount for a house based on either household income-to-debt estimates or fixed monthly budgets. Use our home affordability calculator and get on the road to your dream home with Guaranteed Rate.

The waiting lists can take years and even then tenants may have to relocate. With these details plugged in the affordability calculator will provide you with conservative and aggressive loan estimates. Annual real estate taxes.

Try the mortgage calculator to find out how much you can expect to pay on a 15-year mortgage compared to a current 30-year mortgage. With four bedrooms and three baths this 3000-square-foot home costs. 25- and 30-year mortgages.

This mortgage affordability calculator helps you figure out how much house you can afford by analyzing your monthly income existing debts and assumed payment level. Purchasing a home is a decision that will impact your financial situation for the next 15 to 30 years. You dont have a trade-in and you choose a 48-month loan at 4.

In the United States the ideal down payment for a house is 20 but people typically make down payments from anywhere between 5 and 20 depending on the loan. By default 250000 30-yr fixed-rate loans are displayed in the table below. Since 2010 20-year and 15-year fixed-rate mortgages have grown more common.

What is your credit score range. The cost is dependent on the price of the house which ranges between 30 to 910. Using the affordability calculator is really simple you just need to ensure you know the following information first.

To qualify for the loan your front-end and back-end DTI ratios must be within the 2836 DTI limit calculator factors in homeownership costs together with your other debts. 7011 Homes for Sale in Toronto Ontario. The amount of time you have to pay back the loan either 10 15 or 30 years.

See the results below. Trent Park has a minimum of 30 for the share whereas Leon House only requires 25. Likewise a more expensive home requires a higher land registry fee.

But insurance premiums add up over the length of a 30-year home loan. This interactive affordability calculator is designed to help you determine how much house you can afford. In the example above an additional 100 per month took 15 years off a 30-year mortgage.

In case someone is willing to pay monthly over the next 30 years 700 for a house loan lets figure out how much he can afford to borrow at different interest rate. While your personal savings goals or spending habits can impact your. Lock-in Redmonds Low 30-Year Mortgage Rates Today.

In addition to using the above affordability calculator you may want to check out our monthly mortgage repayment calculator to estimate your monthly payments for various loan scenarios. We calculate this based on a simple income multiple but in reality its much more complex. Get the info you need.

Renters in the 16- to 24-year-old age bracket allocate an average of 468 of their gross income each month to renthouseholds in this age group also pay the highest rental prices. They are mainly intended for use by US. But remember these affordability calculator estimates are used as a general.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. Today 15-year mortgage payments are comparable to 30-year mortgage payments at the higher interest rates. Aside from owing less on your home there are other advantages to putting at least 20 toward your down payment such as not having to pay private mortgage insurance PMI.

When it comes to calculating affordability your income debts and down payment are primary factors. Filters enable you to change the loan amount duration or loan type. For a 300000 house 30-year mortgage at a 35 interest rate having a 60000 down payment youd pay around 1078.

Rent is usually 30 of the regular cost after accounting for necessary expenses. How to Use the Money Under 30 Car Affordability Calculator. But the exact costs of your mortgage will depend on its length the rate you get and other factors.

Factors that impact affordability. Will be after youve closed on a home and gives you a better sense of what youre comfortable paying when you buy a house. Also the House Affordability Calculator or Mortgage Calculator can then help determine an affordable home and subsequent monthly mortgage payment.

Explore homebuyer and rental guides use mortgage calculators renovation and maintenance tips. How much can I borrow. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

Rent Affordability by Age Not surprisingly young adults earning entry-level wages spend the highest proportion of their earnings on rent payments.

Real Estate Calculators Mortgage Rent Vs Buy Affordability More

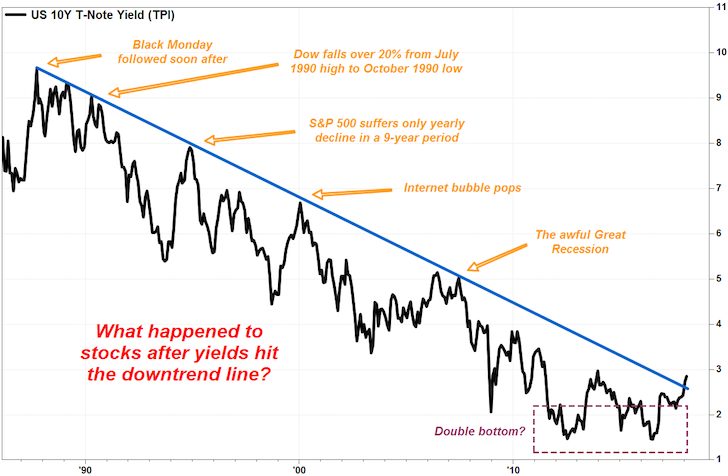

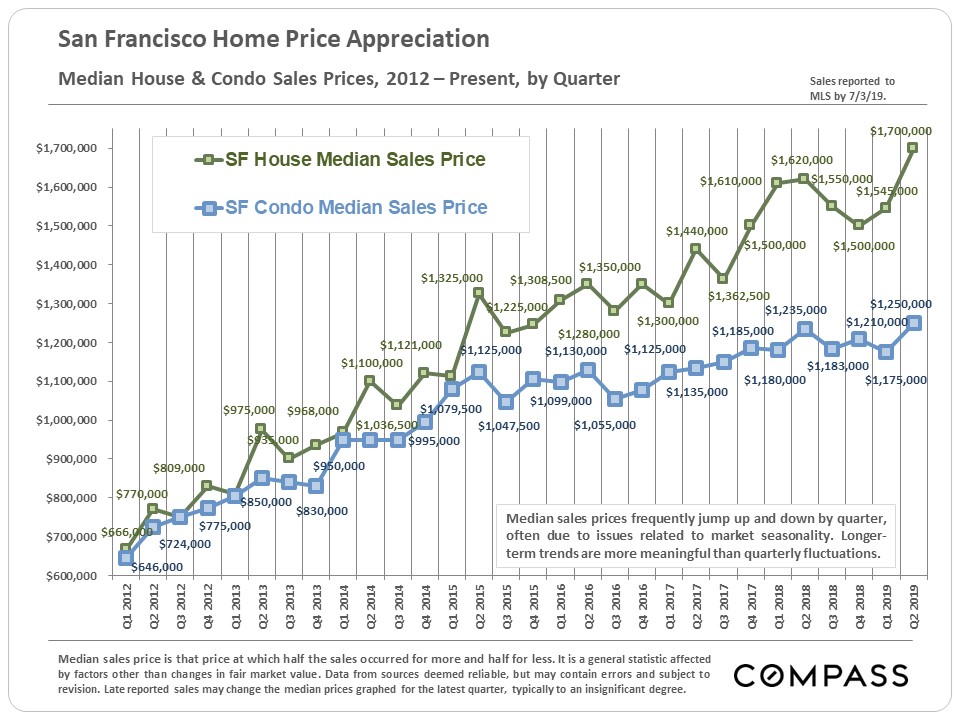

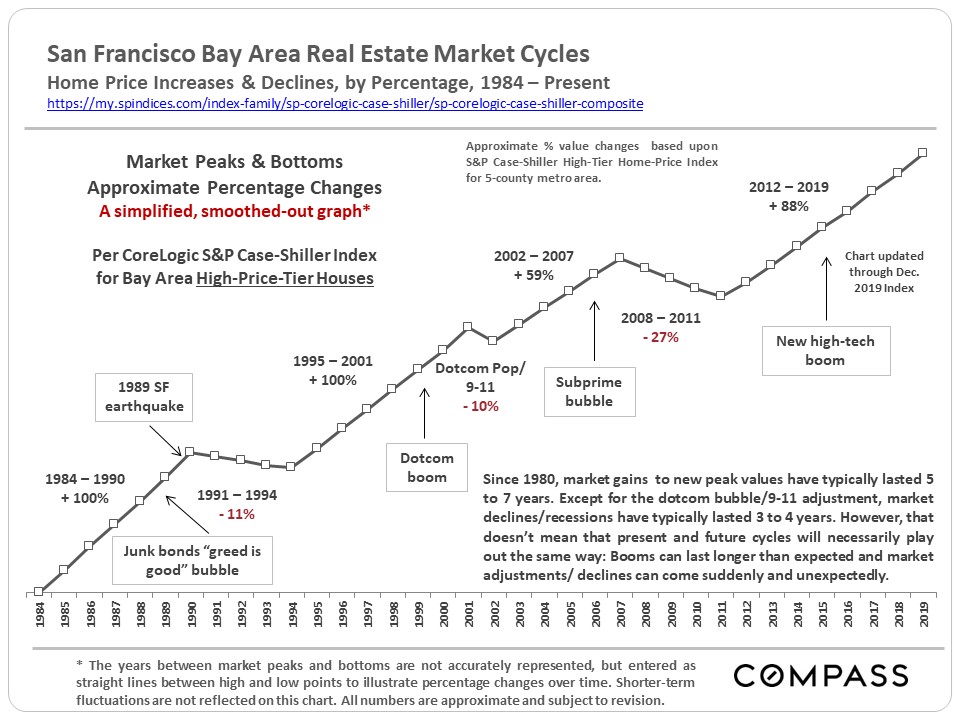

30 Years Of Housing Market Cycles In The San Francisco Bay Area Investsf

30 Questionnaire Templates And Designs In Microsoft Word Inside Business Requirements Questionnaire Templ Questionnaire Template Questionnaire Survey Template

1

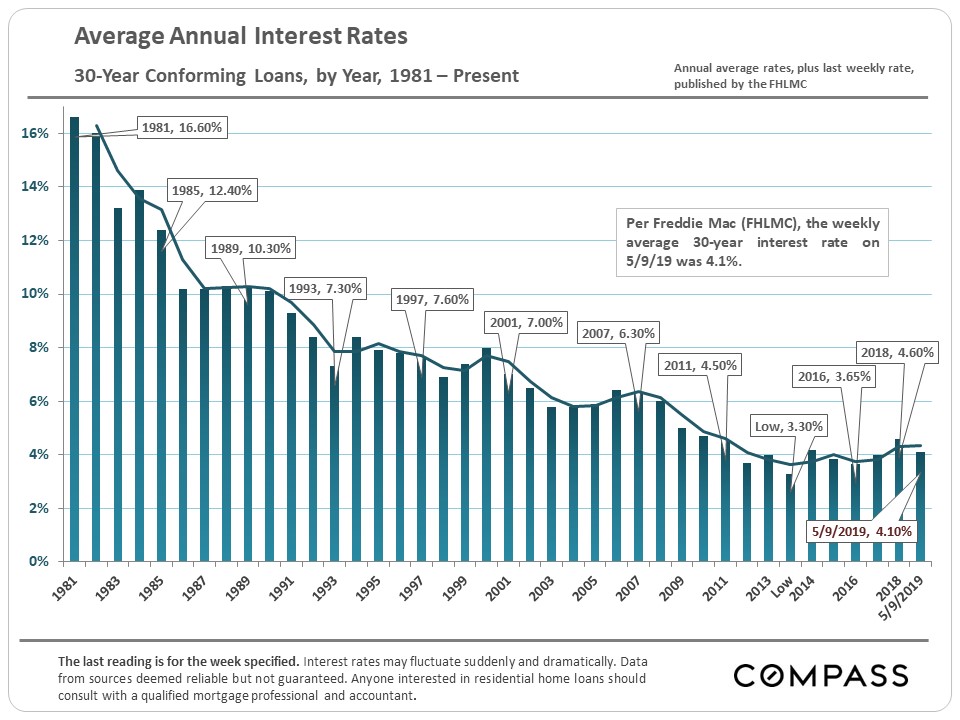

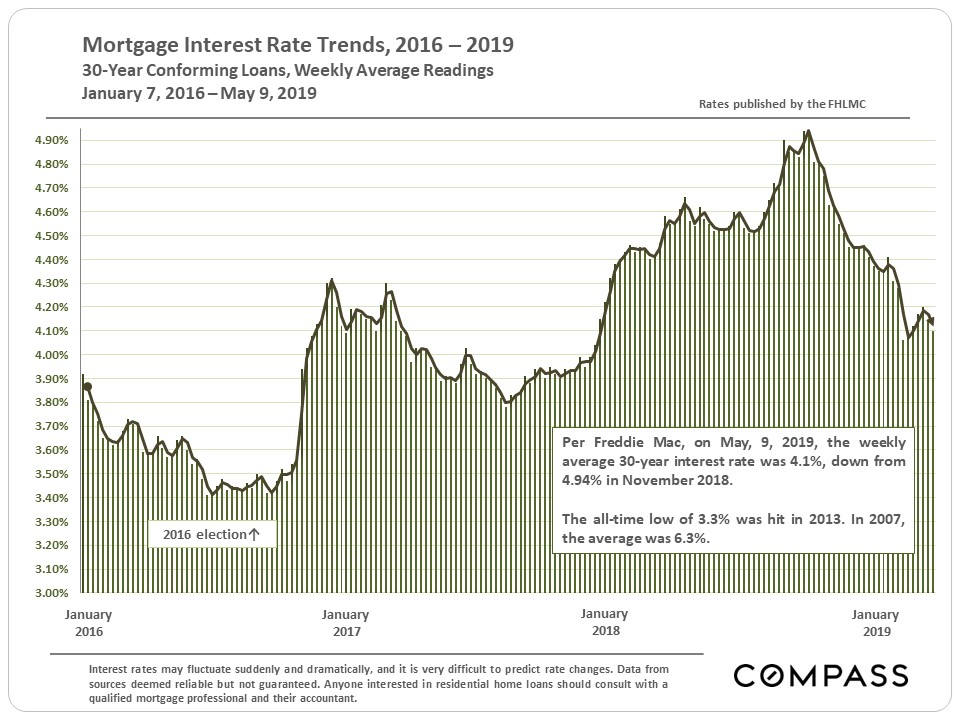

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

3

30 Years Of Housing Market Cycles In The San Francisco Bay Area Investsf

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Best 10 Mortgage Calculator Apps Last Updated September 4 2022

30 Years Of Bay Area Real Estate Cycles Compass Compass

Home Affordability Calculator Cnnmoney Cnn Money Financial Apps Make More Money

Recessions Recoveries Bubbles 30 Years Of Housing Market Cycles In San Francisco Marin Haven Group

30 Years Of Bay Area Real Estate Cycles Compass Compass

1

30 Years Of Bay Area Real Estate Cycles Compass Compass

1

30 Years Of Bay Area Real Estate Cycles Compass Compass